How Animals Danger Protection (LRP) Insurance Policy Can Protect Your Livestock Financial Investment

Livestock Danger Defense (LRP) insurance stands as a reliable shield versus the unpredictable nature of the market, using a critical method to securing your possessions. By delving into the ins and outs of LRP insurance and its multifaceted benefits, animals manufacturers can fortify their investments with a layer of protection that goes beyond market variations.

Understanding Livestock Threat Security (LRP) Insurance

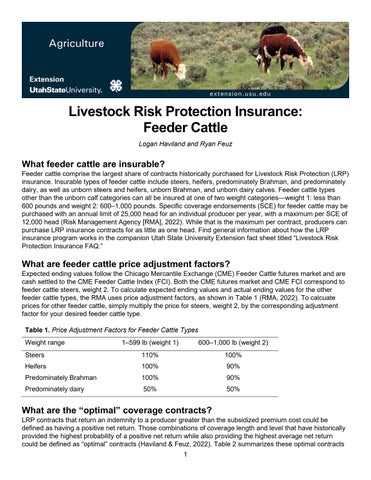

Understanding Animals Risk Defense (LRP) Insurance coverage is important for animals producers looking to minimize monetary threats connected with price variations. LRP is a federally subsidized insurance policy product made to safeguard manufacturers against a decline in market costs. By providing protection for market price decreases, LRP helps manufacturers lock in a flooring price for their animals, guaranteeing a minimal level of profits regardless of market variations.

One key aspect of LRP is its versatility, allowing manufacturers to customize coverage degrees and plan lengths to match their specific demands. Producers can select the variety of head, weight array, protection cost, and insurance coverage period that line up with their manufacturing objectives and risk resistance. Understanding these adjustable choices is essential for manufacturers to properly manage their cost danger exposure.

Additionally, LRP is readily available for various livestock types, consisting of livestock, swine, and lamb, making it a functional threat management tool for livestock producers across various fields. Bagley Risk Management. By familiarizing themselves with the intricacies of LRP, producers can make educated decisions to secure their financial investments and make certain economic security in the face of market uncertainties

Advantages of LRP Insurance for Livestock Producers

Livestock producers leveraging Animals Danger Defense (LRP) Insurance policy acquire a strategic benefit in shielding their financial investments from cost volatility and securing a secure monetary footing among market uncertainties. By establishing a floor on the price of their animals, producers can mitigate the danger of significant economic losses in the event of market downturns.

In Addition, LRP Insurance provides manufacturers with tranquility of mind. Overall, the advantages of LRP Insurance for livestock producers are substantial, providing a useful device for taking care of threat and ensuring financial safety and security in an unforeseeable market setting.

Just How LRP Insurance Mitigates Market Threats

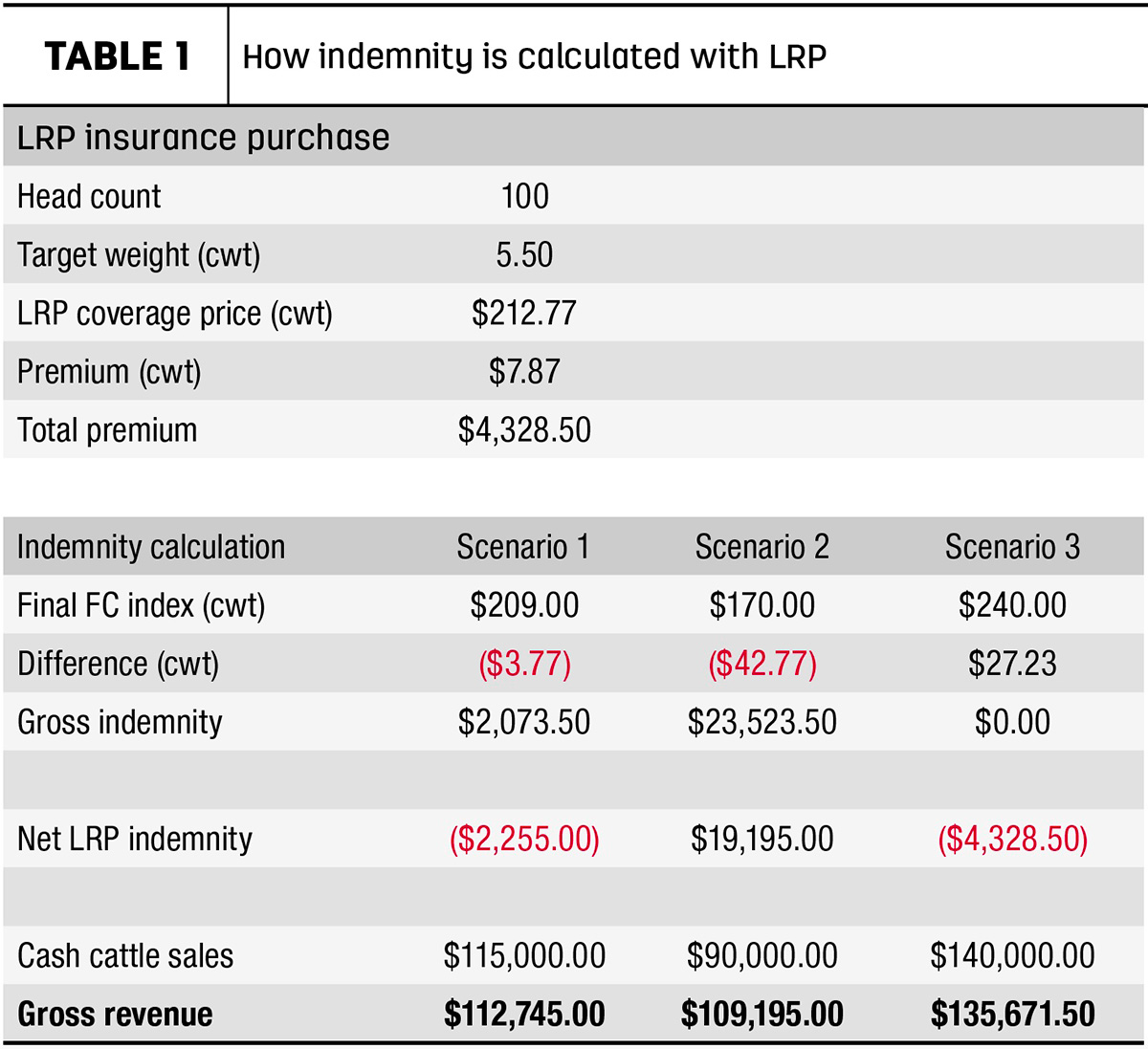

Reducing market threats, Livestock Danger Security (LRP) Insurance coverage supplies livestock manufacturers with a dependable guard against price volatility and financial uncertainties. By supplying defense versus unexpected rate declines, LRP Insurance coverage aids producers secure their financial investments and preserve monetary stability in the face of market variations. This sort of insurance policy permits animals manufacturers to secure a cost for their animals at the beginning of the plan period, making sure a minimum cost degree no matter market modifications.

Actions to Secure Your Livestock Investment With LRP

In the world of agricultural risk management, executing Livestock Threat Protection (LRP) Insurance policy includes a critical process to protect financial investments versus market fluctuations and uncertainties. To secure your animals financial investment efficiently with LRP, the initial step is to evaluate the certain dangers your procedure encounters, such as cost volatility or unforeseen weather occasions. Recognizing these dangers enables you to identify the coverage degree required to secure your investment effectively. Next, it is crucial to study and pick a reputable insurance policy copyright that uses LRP policies tailored to your animals and service requirements. Carefully examine the policy like this terms, problems, and insurance coverage restrictions to guarantee they straighten with your danger management objectives when you have selected a company. Additionally, routinely keeping track of market fads and readjusting your coverage as needed can help enhance your security against possible losses. By following these actions vigilantly, you can enhance the protection of your animals investment and browse market uncertainties with self-confidence.

Long-Term Financial Safety With LRP Insurance Policy

Ensuring withstanding economic security via the use of Animals Threat Defense (LRP) Insurance policy is a prudent long-lasting method for agricultural manufacturers. By integrating LRP Insurance coverage right into their danger monitoring plans, farmers can protect their animals investments against unpredicted market variations and adverse events that might endanger their monetary health with time.

One key benefit of LRP Insurance policy for long-lasting monetary protection is the tranquility of mind it supplies. With a reliable insurance coverage in position, farmers can minimize the monetary risks related to volatile market problems and unforeseen losses as a result of aspects such as disease episodes or natural calamities - Bagley Risk Management. This stability permits producers to concentrate on the daily procedures of their livestock business without consistent concern concerning prospective economic obstacles

Moreover, LRP Insurance policy offers an organized method to taking care of danger over the lengthy you can look here term. By setting details protection degrees and choosing ideal recommendation durations, farmers can tailor their insurance policy prepares to straighten with their monetary goals and risk resistance, ensuring a sustainable and protected future for their livestock procedures. To conclude, purchasing LRP Insurance coverage is an aggressive method for farming producers to accomplish lasting monetary security and secure their livelihoods.

Final Thought

In verdict, Animals Danger Defense (LRP) Insurance coverage is a useful tool for livestock producers to minimize market threats and protect their investments. It is a wise selection for guarding livestock investments.